By Kyle Bergacker

The US labor market has navigated a complex landscape over the past two years, balancing resilience with emerging challenges. Over the last few years, the labor market has shown surprising durability despite high interest rates, inflation, and policy uncertainties like tariffs and federal workforce reductions. Most Americans are familiar with headline unemployment numbers, but fewer grasp the broader dynamics shaping job creation, wage growth, and workforce participation.

The labor market can be likened to a household managing its workforce. Just as a family balances income, expenses, and savings, the economy juggles job openings, labor force participation, and wage growth to sustain growth. When job creation outpaces workforce growth, employers compete for workers, driving wages higher. Conversely, when participation lags or layoffs rise, the balance tilts toward employers, cooling wage pressures.

US Unemployment Rate

In 2024, the unemployment rate averaged 4.1%, up from 3.6% in 2023, yet remained near historic lows. By June 2025, it stabilized at 4.1%, down from 4.2% in May, defying forecasts of a rise to 4.3%. Despite decent looking headline unemployment rates, job creation has slowed in recent years. Sectoral trends show healthcare and state government leading gains while federal government jobs declined due to efficiency measures. Wage growth has also moderated from 5.2% in 2023 to 4.0% in 2024, and further to 3.7% year over year in June 2025 — albeit still outpacing inflation at 2.4% — maintaining workers’ purchasing power.

US Average Hourly Earnings

Labor force participation remained a concern, dropping to 62.3% in June 2025, the lowest since late 2022, down from 62.7% in 2024 and pre-pandemic levels of 63.4%. This decline, partly linked to immigration policy changes and early retirements, reflects 130,000 people leaving the labor force in June alone. Long-term unemployment rose by 190,000 to 1.6 million, signaling challenges for job seekers re-entering the market. These trends highlight persistent labor shortages, with 7.2 million job openings in May 2025, down from 8.5 million in late 2024 but still elevated.

US Labor Force Participation Rate

Labor force participation remained a concern, dropping to 62.3% in June 2025, the lowest since late 2022, down from 62.7% in 2024 and pre-pandemic levels of 63.4%. This decline, partly linked to immigration policy changes and early retirements, reflects 130,000 people leaving the labor force in June alone. Long-term unemployment rose by 190,000 to 1.6 million, signaling challenges for job seekers re-entering the market. These trends highlight persistent labor shortages, with 7.2 million job openings in May 2025, down from 8.5 million in late 2024 but still elevated.

US Labor Force Participation Rate

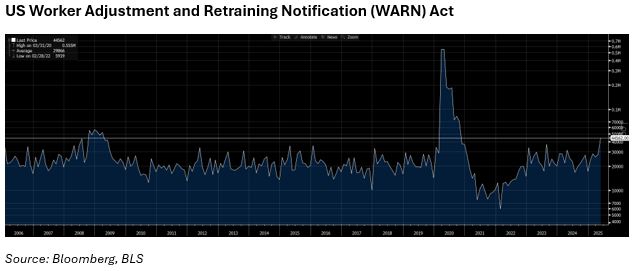

We believe consumer confidence, employment data, and monetary policy will be critical to watch in the months ahead, and that the US labor market remains mostly resilient, supported by steady job growth and real wage gains. However, low participation, long-term unemployment, further upticks in the WARN Act data, and policy headwinds could dent the momentum. For investors, a stable labor market supports our consumer-driven economy and bolsters stock market confidence. We continue to closely monitor labor dynamics to assess their impact on economic and market trajectories for the months ahead.